Forza Pushes Permian Gas Pipeline as Takeaway Bottlenecks Persist

Forza Pipeline LLC is defending its proposed 36-inch, 750,000 Dth/d Delaware Basin gas pipeline at FERC, arguing strong shipper support and continued Permian takeaway constraints tied to LNG demand.

By Mary Holcomb, Lead Digital Editor

(P&GJ) — Targa Resources subsidiary Forza Pipeline LLC is pushing back against opposition to its proposed 36-inch interstate natural gas pipeline in the Delaware Basin, filing a Jan. 27 Joint Motion to Answer at the Federal Energy Regulatory Commission (FERC) defending the project’s market need, commercial support and regulatory structure.

In the filing, the company contends that critics have mischaracterized the project’s purpose, stating that “project opponents’ Waha-oversupply argument is a red herring.”

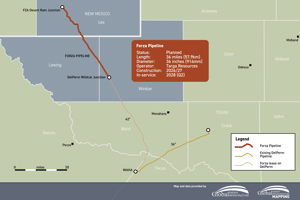

According to Targa Resources, the proposed Forza project would consist of approximately 36 miles of 36-inch-diameter pipeline originating at Desert Ram Junction in Lea County, New Mexico — where it would connect with residue gas from Targa’s Red Hills Plant and the planned Copperhead Plant — and extend to Wildcat Junction in Winkler County, Texas. From there, the project includes 43 miles of leased capacity on Bull Run Pipeline’s 42-inch extension to the Waha Hub in Pecos County, Texas.

Pipeline Route and Information

For an overview of this project and other related infrastructure developments, visit Global Energy Infrastructure.

The pipeline is designed to transport up to 750,000 dekatherms per day (Dth/d) of residue gas from southeastern New Mexico to downstream markets in Texas, including connections to interstate pipelines and Gulf Coast LNG demand centers.

In the filing, Forza argued the project would “provide shippers greater access to downstream markets by alleviating the production-area bottleneck and enabling Delaware Basin gas to flow to the interconnected pipeline grid.”

The filing responds to protests submitted in Docket Nos. CP26-34-000 and CP26-35-000, which relate to the interstate facilities proposed by Forza and associated intrastate infrastructure to be developed by Bull Run Pipeline LLC.

Market Need and Takeaway Constraints

At the center of the dispute is whether additional takeaway capacity is needed to move natural gas from the Delaware Basin toward downstream markets.

“The Forza Project is not designed to remedy a shortage of gas at Waha,” Forza wrote in the filing. “Rather, the project addresses a well-documented and growing need for additional takeaway capacity from the Delaware Basin, where natural gas production continues to increase and is projected to outpace existing residue‐gas transportation capacity.”

Forza maintains that production growth in the basin continues to strain existing infrastructure, particularly in areas near Red Hills and Copperhead. While some commenters argue that oversupply at the Waha Hub reduces the need for new infrastructure, Forza contends that Waha functions primarily as a pricing and interconnection point — not the final destination for gas.

According to the company, the project is intended to relieve upstream constraints and provide improved access to downstream markets, including LNG export facilities along the Gulf Coast. Forza argues that continued Permian production growth and sustained LNG demand support incremental pipeline capacity.

The company states that approximately 87% of the project’s capacity is backed by precedent agreements, including commitments from affiliate and non-affiliate shippers. Forza argues that this level of subscription demonstrates strong commercial backing under FERC’s Certificate Policy Statement standards.

Regulatory and Segmentation Issues

Opponents have argued that the Forza and Bull Run facilities should be evaluated together under FERC jurisdiction.

Forza counters that Bull Run’s facilities are intrastate and subject to regulation by the Railroad Commission of Texas. The company maintains that the projects have independent utility and are appropriately reviewed under separate regulatory frameworks.

In its motion, Forza asserts that protest arguments misapply FERC’s segmentation standards and that the interstate pipeline should proceed under the Natural Gas Act without delay.

Timeline and Next Steps

Forza has applied to FERC for a certificate of public convenience and necessity under Section 7(c) of the Natural Gas Act. Pending regulatory approvals, the company expects construction to begin in mid-2027, with service targeted for early 2028.

In their conclusion, the Joint Applicants urge the Commission to “issue the authorizations requested in the Application by November 2026… to meet the planned in-service date of January 2028 for the Project.”

If approved, the project would add 750,000 Dth/d of new interstate takeaway capacity out of the Delaware Basin, enhancing connectivity to the Waha Hub and downstream Gulf Coast markets as Permian production growth continues.